As investors contend with the difficult task of assessing the impact of tariffs and their consequences, one question that’s emerged is: will companies adjust their non-GAAP earnings measures to exclude tariffs? A corollary: tariffs are taxes, so are they added back in earnings before interest, taxes, depreciation and amortization (EBITDA)?

Since companies generally did not make non-GAAP adjustments for prior tariffs (e.g., tariffs imposed by the United States on Chinese imports in 2018), and based on our understanding of the Securities and Exchange Commission’s guidance on non-GAAP financial measures, we think the answer is no. But we do expect companies to quantify and call out the impact of tariffs, if they are material, leaving it up to investors to ignore or incorporate the impact of tariffs in valuation.

Tariffs are recurring costs that are settled in cash. Tariffs may also be passed on to customers. We think “adjusting out” the impact of tariffs is inappropriate, akin to adjusting out rising or falling commodity prices. Call outs by managers to quantify the impact are very helpful, however, as investors parse out the drivers of performance from one period to the next.

Very few companies adjusted earnings for tariffs in recent years

We searched the population of non-GAAP reconciliations of SEC filers for “tariff” using Calcbench. We found mentions by 22 companies, but fewer than five instances where the impact of tariffs was excluded from a non-GAAP financial measure.

This is a tiny subset of the >175 of S&P 500 companies that mentioned “tariffs” in their earnings calls in 2018 and >250 companies that did so in 2024, according to FactSet Earnings Insight. (We don’t have data for mentions of “tariff” among all SEC filers that host earnings calls, but those numbers are very likely higher).

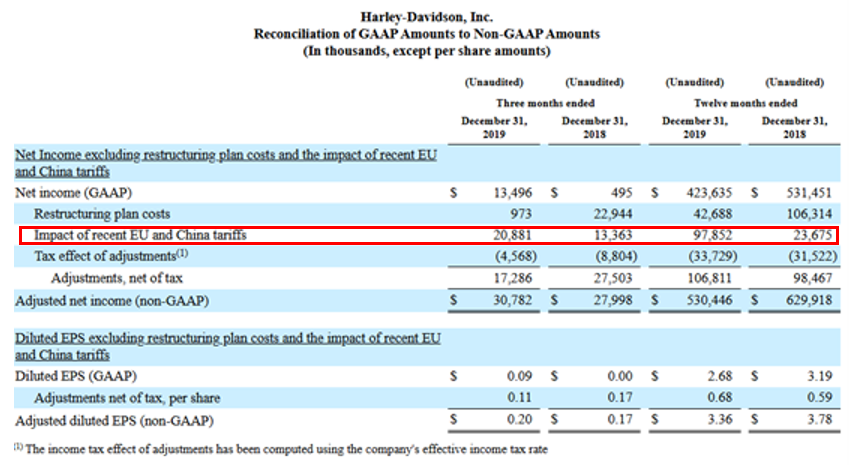

One of the rare examples is in Harley Davidson’s Fourth Quarter and Full Year 2019 earnings release furnished on Form 8-K with the SEC, an excerpt of which is reproduced below.

“The non-GAAP measures included in this press release are adjusted net income and adjusted diluted EPS excluding restructuring plan costs and the impact of recent EU and China tariffs. Restructuring plan costs include restructuring expenses as presented in the consolidated statements of income and costs associated with temporary inefficiencies incurred in connection with the manufacturing optimization initiative included in Motorcycles and Related Products cost of goods sold. The impact of recent EU and China tariffs includes incremental European Union and China tariffs imposed beginning in 2018 on the company’s products shipped from the U.S., as well as incremental U.S. tariffs imposed beginning in 2018 on certain items imported from China. The impact of recent EU and China tariffs excludes higher metals cost resulting from the U.S. steel and aluminum tariffs. These adjustments are consistent with the approach used for 2018 to determine performance relative to financial objectives under the company’s incentive compensation plans. A reconciliation of these non-GAAP measures from the comparable GAAP measure is included later in this press release.”

Source: Harley-Davidson Announces Fourth Quarter, Full-Year 2019 Results

Harley Davidson discontinued the tariff-related non-GAAP adjustments after the European Union suspended tariffs on the company’s products in late 2021, though the tariffs on items imported from China remain in place.

While quantifying the impact of the tariffs is helpful, the overall usefulness of this non-GAAP adjustment is limited by the fact that it may not be possible to quantify earnings as if tariffs were never imposed. Tariffs interact with the business environment in numerous and complex ways. Absent from Harley Davidson’s disclosure above, for example, is whether the cost of the tariffs was passed through to customers, whether it affected competitors and substitute products to the same degree, and whether the company took any offsetting cost actions.

Our understanding of the SEC’s guidance is that adjusting out tariffs is inappropriate

Besides scant historical evidence, another reason we believe companies will not adjust out tariffs in their non-GAAP earnings is the SEC staff’s Compliance & Disclosure Interpretations. As recently as December 2022, the staff clarified that a non-GAAP measure excluding “normal, recurring, cash operating expenses necessary to operate a registrant’s business” could be misleading.

Question: Can certain adjustments, although not explicitly prohibited, result in a non-GAAP measure that is misleading?

Answer: Yes. Certain adjustments may violate Rule 100(b) of Regulation G because they cause the presentation of the non-GAAP measure to be misleading. Whether or not an adjustment results in a misleading non-GAAP measure depends on a company’s individual facts and circumstances.

Presenting a non-GAAP performance measure that excludes normal, recurring, cash operating expenses necessary to operate a registrant’s business is one example of a measure that could be misleading.

When evaluating what is a normal operating expense, the staff considers the nature and effect of the non-GAAP adjustment and how it relates to the company’s operations, revenue generating activities, business strategy, industry and regulatory environment.

The staff would view an operating expense that occurs repeatedly or occasionally, including at irregular intervals, as recurring (December 13, 2022).

Source: SEC.gov | Non-GAAP Financial Measures

Of course, interpreting the guidance is a matter of judgment that issuers make with their disclosure counsel, but our view from an investor perspective is that tariffs are normal, recurring, cash operating expenses necessary to operate a business, especially if that business already has an established history of paying tariffs or economically similar taxes in various countries.

A company may be able to argue that a change in tariff rates, especially a significant change, is not “normal” if such changes have happened rarely, which may be the case for the Harley Davidson example. In those cases, it is useful for investors to be able to size the impact of the change, while still acknowledging that tariffs are a “real” cost that may not be temporary.

We think it should be left up to investors to exclude the impact of tariffs, or not

We think company managers “adjusting out” the impact of tariffs is inappropriate, akin to adjusting out rising or falling commodity prices. Tariffs are (in the short run, at least) unavoidable costs of doing business, recurring, and settled in cash. To the extent they are not fully passed through to customers — or if they cause demand destruction — tariffs are a loss of value of investors, as evidenced by the recent contraction in share prices.

That said, managers scoping and quantifying the impact of tariffs on their business, even if it’s an estimate, is helpful for investors to parse out the drivers of performance from one period to the next. If investors want to exclude the impact of tariffs from earnings or other measures, perhaps with expectation that the tariffs are temporary, that is their decision.

Special thanks to Pranav Ghai at Calcbench for helping with this blog.